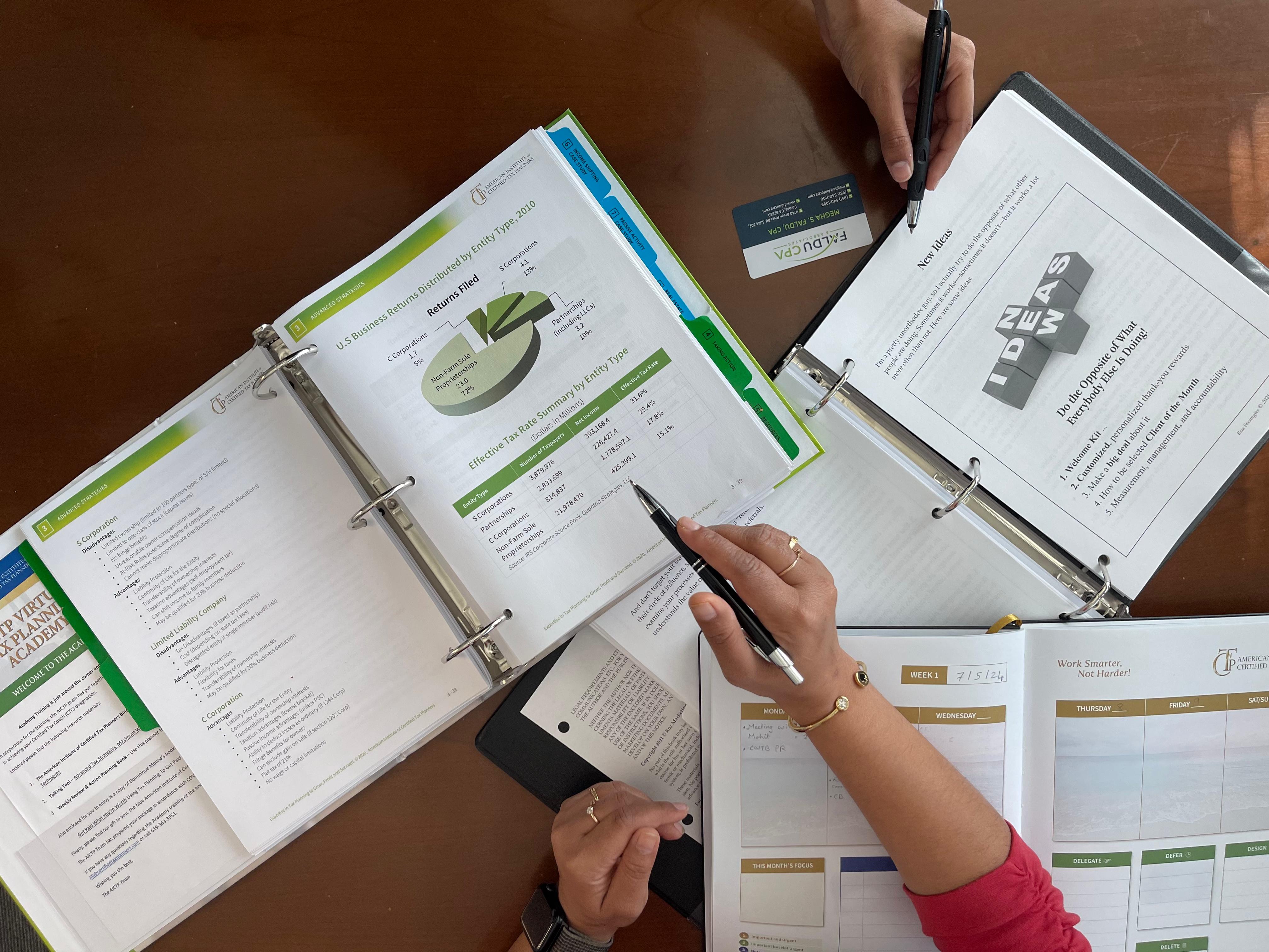

Tax Planning

Our expert team crafts personalized tax strategies to optimize your position ,maximize returns and ensure compliance. We offer tax planning services by understanding our clients financial situation ,goals ,and concerns and analyzing any upcoming life events that could impact their tax situation.

We conduct a comprehensive review of the client tax situation,including their past tax returns,current income,expenses.investments and potential tax saving opportunities. We develop and customize a tax plan that aligns with the clients long term financial goal. We continuously make sure to monitor our clients tax situations and adjust their tax plan as needed based on the changes of their financial circumstances ,tax law or other relevant factors

We communicate proactively with our clients throughout the year, not just during tax season by providing proactive

- Business management

- Tax Compliance

- Accounting and payroll solutions (operations & management)

- Financial management

- Financial reporting